- #Best financial planning apps how to#

- #Best financial planning apps software#

- #Best financial planning apps free#

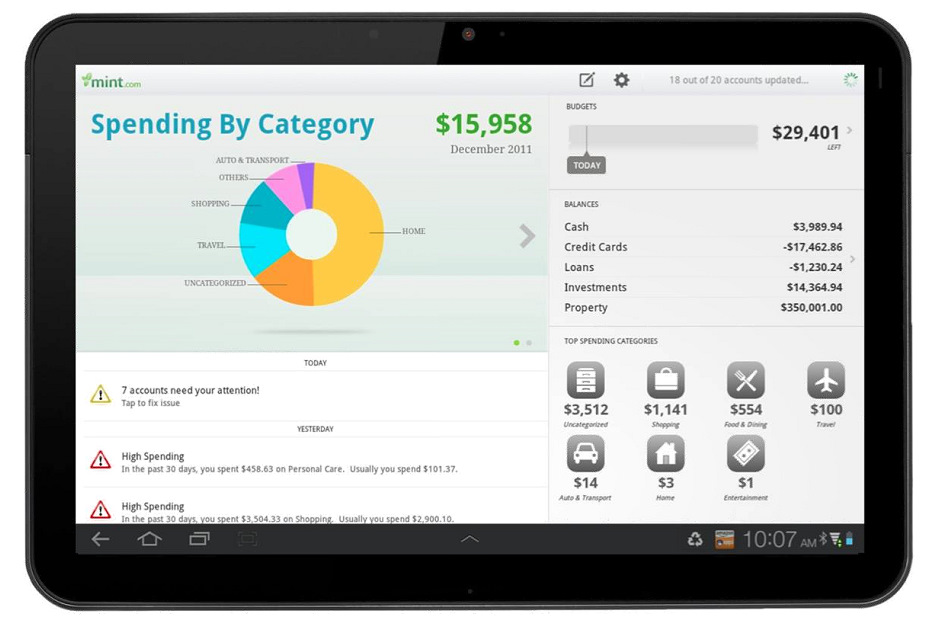

These features make Mint a solid pick for couples but unlike Honeydue, Mint doesn't offer the option to create a joint checking account for you and your partner. The app also has a monthly bill payment tracker allows you see all your bills at one glance, and you can get reminders on upcoming due dates and alerts if your funds are low. The app will even send alerts if you're being charged an ATM fee, going over budget or if there's been a large or suspicious transaction on any of the connected accounts.

You can also create your own savings goals as a couple and track your investments in the app. And it'll automatically categorize all transactions so you and your partner don't have to manually enter purchases and deposits, but you'll also have the option to revise and add categories as needed.

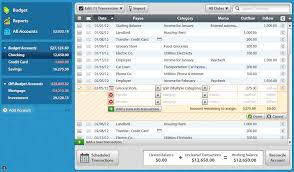

Mint syncs to your bank accounts, credit cards and retirement accounts to track your income, purchases and savings. Who's this for? While the Mint app isn't actually targeted toward couples, the fact that it allows you to connect several different accounts can make it easier for couples to categorize their spending automatically. Some couples may find that 20 envelopes aren't enough for them, in which case they may consider upgrading to the premium version of Goodbudget for $70 a year or $8 a month the premium version allows the use of unlimited envelopes, access to the account on up to five devices, access to seven years' worth of transaction history and debt tracking.

#Best financial planning apps free#

The Goodbudget app has a free version which lets you create 20 envelopes, use the app on up to two devices, track one year's worth of transaction history and track debt. However, some people may find manually inputting their transactions to be tedious. This actually forces couples to take a hands-on approach to managing their money since they'll have to actually check to see how much they're spending in order to upload purchases to the app. Instead, you manually input your transactions into each digital envelope. Unlike most budgeting and expense tracker apps, Goodbudget does not link to users' bank accounts and credit cards. The envelope method is generally recommended for people who are new to budgeting, so if you and your partner need a way to ease into categorizing your spending, the app might be able to improve your confidence in that area. Users are only supposed to spend the amount allocated to each envelope, and if they go beyond their budget the envelope will show red to indicate that they overspent. This makes it easy to prioritize your spending and plan ahead. The account has free ATM access, a debit card for both partners and no monthly fees or minimums. Partners can also split expenses with each other directly in the app.Īnd, Honeydue is also offering its own joint bank account. If you or your partner are reaching a certain spending limit, you both will be alerted. And with bill payment reminders and monthly spending limits that users set up in each category, the app helps couples make sure they aren't overspending.

The app also allows you to track spending and coordinate bill payments so you're both on the same page. In other words, loans, investments, checking accounts and savings accounts can all be shared with your partner, but the app allows both of you to choose which accounts you want to actually connect. Who's this for? The Honeydue budgeting app makes it easy for you and your partner to get a comprehensive view of your finances together without having to log into a bunch of different accounts every single time. Investing +More All Investing Best IRA Accounts Best Roth IRA Accounts Best Investing Apps Best Free Stock Trading Platforms Best Robo-Advisors Index Funds Mutual Funds ETFs Bonds

#Best financial planning apps how to#

Help for Low Credit Scores +More All Help for Low Credit Scores Best Credit Cards for Bad Credit Best Personal Loans for Bad Credit Best Debt Consolidation Loans for Bad Credit Personal Loans if You Don't Have Credit Best Credit Cards for Building Credit Personal Loans for 580 Credit Score Lower Personal Loans for 670 Credit Score or Lower Best Mortgages for Bad Credit Best Hardship Loans How to Boost Your Credit Score

#Best financial planning apps software#

Taxes +More All Taxes Best Tax Software Best Tax Software for Small Businesses Tax Refunds Small Business +More All Small Business Best Small Business Savings Accounts Best Small Business Checking Accounts Best Credit Cards for Small Business Best Small Business Loans Best Tax Software for Small Business Personal Finance +More All Personal Finance Best Budgeting Apps Best Expense Tracker Apps Best Money Transfer Apps Best Resale Apps and Sites Buy Now Pay Later (BNPL) Apps Best Debt Relief Best Mortgages for Average Credit Score.Best Loans to Refinance Credit Card Debt.

0 kommentar(er)

0 kommentar(er)